5 minute read

Outcome-based pricing ties vendor revenue to real results, aligning price with value and helping future-proof monetization in the age of AI. Learn what outcome-based pricing is, how it compares to other pricing models, and the pros and cons.

When products fail due to flaws, it makes sense. But what if your product fails because it’s too good?

It’s not absurd to imagine that scenario now, when one AI agent has the potential to replace ten or even a hundred users. Typical software pricing strategies, like per-seat licenses, offer consistency and predictability. But in the age of AI, it can mean that the better your product becomes, the less you earn.

Eventually, declining revenue makes the business unsustainable.

This explains why Growth Unhinged’s 2025 State of B2B Monetization report found that seat-based pricing dropped from 21% to 15% of companies in just 12 months.

A common solution to this new challenge is consumption or usage pricing (like tokens or API calls). However, activity alone doesn’t equal value. Moreover, it’s problematic when buyers can’t predict usage costs or see clear returns. Often, they will hesitate to adopt products with unpredictable pricing models.

Some current pricing models are no longer effective, leading to a growing interest in newer strategies, such as outcome-based pricing.

What Is Outcome-Based Pricing?

Outcome-based pricing is a model where customers pay only after achieving clearly defined business outcomes, typically financial results like increased revenue or reduced costs. Unlike traditional pricing, it requires vendors to share risk with buyers.

While outcome-based pricing can drive significant results, it requires robust data infrastructure, clear legal frameworks and careful risk management. We’ll explore the challenges and the opportunities of outcome-based pricing throughout this piece.

Examples of Outcome-Based Pricing

Outcome-Based Pricing Example 1: Intercom

Eight weeks after ChatGPT launched, Intercom released its first AI-powered product. Six weeks after that, Fin, an AI Agent for customer service, went online.

Fin leverages an outcome-based pricing model that puts buyer and seller interests in perfect alignment. Instead of charging for seats or message volume, Intercom put a 99‑cent price tag on a single outcome: one solved ticket.

If Fin fails, no charge.

This pay‑per‑resolution model forces Intercom to focus on A/B tests that nudge the resolution rate upward, which feeds straight into both revenue and customer value. As a result, improvements ship quickly, and Fin’s revenue has quadrupled year‑over‑year.

Examples like Intercom show that buyers will gladly trade predictable seat licenses for a meter that moves only when the work is done. When a supplier prices the outcome instead of the raw inputs, the bill lines up with what the buyer values, creating a powerful incentive structure that benefits everyone.

Outcome-Based Pricing Example 2: Hitachi Rail

It’s not just software companies using outcome-based pricing.

For example, Hitachi Rail operates its “trains-as-a-service” model, owning and maintaining trains while charging customers (like UK and global rail operators) only when trains run on time, via performance-linked contracts.

They use onboard sensors and analytics platforms (e.g., HMAX plus acquired analytics systems) to track punctuality, availability, maintenance efficiency, onboard conditions, energy usage, etc.

Hitachi’s predictive maintenance, IoT, and AI tools keep trains on schedule, and their roadmaps prioritize reliability and KPI-driven features that directly influence payments.

Outcome-Based Pricing Example 3: Zendesk

It’s not all smooth selling, though.

Zendesk, much like Intercom, charges customers based on successful ticket resolutions. However, Zendesk has faced challenges due to ambiguity around what exactly qualifies as a “resolution.” For instance, if an AI bot provides an answer and marks the ticket as resolved, but the customer returns shortly afterward with a follow-up issue or clarification, is that ticket truly resolved? Without clear guidelines and agreement on these metrics, customers may dispute charges, question fairness and lose trust in the pricing model.

The Benefits of Outcome-Based Pricing Models

For the Buyer

Buyers don’t lack options when they’re looking for capable software or clever features. The problem B2B buyers face is deciding which tool is worth the investment. Outcome-based pricing ties your product directly to the KPIs that the buyer has already identified as critical for the organization.

It shields them from “shelf‑ware.”

Most leaders carry scars from paying six figures for tools that never left the pilot phase. Outcome‑based pricing flips that potential problem on its head. The buyer spends little up front and if results stall, the tool stays on the vendor’s balance sheet, not the customer’s.

It tells a clean story to finance.

When cost rises only as downtime falls or revenue climbs, the math is easy to defend in a budget meeting. The price line and the benefit line march in step. That makes the deal feel less like an expense.

It keeps the vendor awake at night.

Because payment is tied to a live metric, the supplier can’t coast after go‑live. Engineers chase bugs that threaten the target, product managers push updates that nudge it upward and success teams stay engaged long-term. The buyer benefits from a partner who has as much to lose from stagnation as they do.

For Your Organization

Outcome-based pricing doesn’t just change your company’s pricing model. It influences the entire product strategy from product roadmap priorities to team workflows.

Shared risk means faster sales cycles.

The buyer sees that the vendor is sharing risk. If the promised result never appears, the buyer will not pay. That reduces fear and can shorten long approval cycles.

The first win creates growth opportunities.

A pilot with one team, region or workflow shows the tool works. A measurable success becomes proof that the wider rollout is safe. Budget owners can point to hard numbers rather than hopes.

Agreement on success metrics reduces confusion and improves effectiveness. Traditional seat‑ or usage‑based models scatter attention across many KPIs. Outcome-based pricing concentrates dashboards, bonuses and roadmap decisions on the single KPI that triggers payment. That alignment speeds bug fixes, feature tweaks and customer coaching.

Outcome-Based Pricing vs Value-Based Pricing

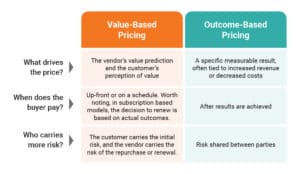

Outcome‑based pricing is not a brand‑new product strategy, it is a subset of value-based pricing that Pragmatic teaches

This pricing model is essentially a more demanding version of value‑based pricing that pushes the seller to prove the predicted value before payment. It often helps overcome the usual challenges of value-based approaches (such as difficulty in assessing and communicating value) by using concrete performance indicators.

Outcome-based pricing is one implementation approach for value based pricing. It makes use

of what we refer to as the “Buyer’s Value Meter”. We want to identify the unit of measure that

drives incremental value for the buyer and price based on that metric. This insures that the

buyer receives the value they are paying for and that the vendor gets paid for the incremental

value they create.

Here is a look at how outcome-based pricing aligns with value-based pricing.

Many value-based pricing models are about prediction and perception. You charge what customers believe your offer is worth, whether or not you later prove that value. Outcome-based pricing is about proof. You charge only when the promised business result appears, shifting more risk to you but opening up an opportunity to capture even more of the value delivered.

Connecting Willingness to Pay and Outcome-Based Pricing

What’s exciting about outcome-based pricing is that it naturally aligns with customers’ willingness to pay because it directly links price to clear, measurable results. When companies charge explicitly for these valued results, customers perceive the pricing as fairer and more transparent. This alignment reduces uncertainty and increases the customer’s confidence that they will pay only for the value they’ll receive.

Customers often accept higher prices under outcome-based pricing in exchange for reduced risk. It is much easier for buyers to evaluate the price they are being asked to pay because it directly aligns with an outcome that they can value. They can compare the value of the outcome to the price they are being asked to pay to determine if it’s “fair.”

For example, Riskified employs outcome-based pricing by charging e-commerce companies exclusively for approved, fraud-free transactions. Customers easily measure the value in prevented losses and confidently accept paying more due to the transparent, measurable results.

One customer review said, “Riskified has greatly reduced the amount of time our team spends manually reviewing orders…Their entire system is easy to use and not overly technical. We have been a client for a couple of years now, and those of us who use Riskified daily are very happy to have it in place.”

Considerations for Outcome-Based Pricing

Cash Flow

- Plan for upfront effort and possible delays in payments when setting budgets.This is much

like the exercise companies go through as they implement subscription based pricing

models. - Account for extra costs if you add features specifically aimed at improving customer outcomes. If the features do improve customer outcomes, then you will get paid for

those features via improved outcomes. - Be prepared for seasonal or market fluctuations that may disrupt the predictability of your monthly revenue.

Legal Complexity and Negotiation Conflicts

- Clearly define baselines, change processes and exit terms early to avoid prolonged negotiations.

- Ensure baselines accurately reflect value to prevent misalignment with buyers.

Measurement and Attribution

- Establish clear, agreed-upon KPIs to prevent disputes or misinterpretation.

- Define how you’ll attribute outcomes when multiple factors influence results.

- If relying on external data or partner performance, consider how you’ll manage those dependencies.

Is Your Business Ready for Outcome-Based Pricing?

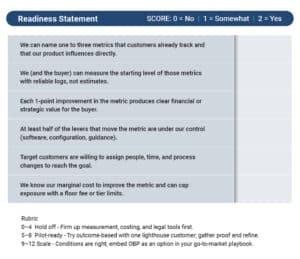

Business Consultant at BearingPoint, Valtteri Arminen completed his master’s thesis in 2022 at Tampere University, exploring whether SaaS companies could shift from charging for seats and features to charging exclusively for clear business outcomes. After months embedded inside a Finnish SaaS firm, he outlined six skills a vendor needs long‑term to maintain margins and make customers stickier.

The following readiness checklist is in part based on his work:

Rubric

- 0–4 Hold off – Firm up measurement, costing, and legal tools first.

- 5–8 Pilot‑ready – Try outcome-based with one lighthouse customer; gather proof and refine.

- 9–12 Scale – Conditions are right; embed OBP as an option in your go‑to‑market playbook.

Conclusion

Whether you scored 0 or 12 on the readiness assessment, outcome-based pricing isn’t just a pricing experiment; it’s a strategy that can fundamentally change how you build, sell and scale your product. Companies like Intercom and Hitachi Rail aren’t just charging differently; they’re creating deeper customer partnerships where success becomes truly mutual.

The companies that master outcome-based pricing first will enjoy a significant competitive advantage. They’ll close deals faster, retain customers longer and build products that customers can’t live without. More importantly, they’ll create businesses that grow stronger every time they deliver value.

Author

-

The Pragmatic Editorial Team comprises a diverse team of writers, researchers, and subject matter experts. We are trained to share Pragmatic Institute’s insights and useful information to guide product, data, and design professionals on their career development journeys. Pragmatic Institute is the global leader in Product, Data, and Design training and certification programs for working professionals. Since 1993, we’ve issued over 250,000 product management and product marketing certifications to professionals at companies around the globe. For questions or inquiries, please contact [email protected].

View all posts