This is the time of year for annual planning. You’ve probably begun working on plans and budgets for next year. Or you will be soon.

But this year it’s different. Because profitability is in, and growth at any cost is out.

You may have been asked to do more with less this year—and next year too. Or you have to do more with the same budget.

Growth Velocity has had success dealing with these common challenges, and I want to share one of those experiences and our process for helping the client improve marketing and sales effectiveness.

Case Study: Casting a Broad Net Increased Customer Acquisition Costs

The client company targets software companies for its quality assurance (QA) offering. To compensate for a drop in new account win rate, they hired more outbound sales development representatives (SDRs). But that decision drove the cost per acquisition (CAC) too high.

Additionally, their go-to-market strategy was to cast a broad net. They broadly targeted mid-market and SMB software companies. We found this broad segmentation and targeting was a primary cause of their high customer acquisition cost.

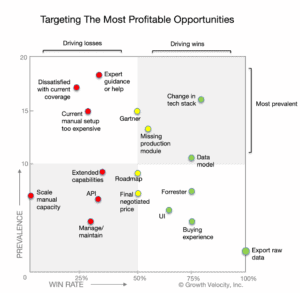

By interviewing buyers in a 50/50 mix of won and lost opportunities, we identified five buyer segments each with a distinct win rate.

For example, the segment with the highest win rate (83%) comprised companies that needed to fix a legacy automated testing solution that was broken (or not working well) or would soon be broken by tech stack changes.

By contrast, buyers in the lowest win rate segment (0%) already had a manual testing capability and wanted to scale it. In another low win rate segment (25%), buyers were looking for a less expensive alternative to their status quo manual testing.

Since this vendor hadn’t segmented on status quo solution, marketing resources were spent to acquire leads that were unlikely to convert into buyers. And then, when leads in these low win rate segments downloaded a white paper, registered for a webinar or asked to speak with sales, they were scored by a model that didn’t consider the status quo. Sales resources were wasted as low propensity opportunities entered the pipeline and consumed precious sales time.

After rolling out the updated targeting, the head of sales development said this about the updated go-to-market strategy:

“I can’t put enough emphasis on how important it is to spin your cycles on high-priority leads. The time savings and peace of mind that comes from knowing all your decisions are backed by complex interviews is a great advantage to have.”

Product Marketing Can Have a Transformative Impact on Your Ability to do More Next Year

When did you last update your segmentation and targeting? Technology markets change quickly. And I find many product marketing teams relied more on intuition and anecdote than actual data when they defined their best fit buyer.

But the number one reason to advocate for this update now is you want to do more with less.

Because better targeting will have a transformative impact on the efficiency of demand generation and field marketing. These resource-intensive programs account for more than half of most B2B marketing budgets.

At the same time, you can help sales improve rep efficiency and effectiveness by updating account scoring and discovery questions.

Six Steps to a Data-Driven Understanding of Your Best-Fit Buyer

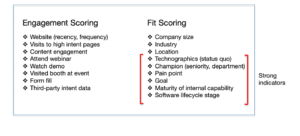

Our analysis goes deeper than firmographic and technographic data about each account. We combine those attributes with buyer interviews to identify the best-fit patterns in the data.

Here’s a summary of our approach to improving segmentation and targeting with buyer interviews.

Step 1: Decide who to interview. You’ll want to interview buyers in both closed-won and closed-lost opportunities because most attributes are associated with both winning and losing. Analyzing an equal mix of both wins and losses you’ll learn how that nets out. Is the attribute more of a positive or negative influence on outcomes?

Step 2: Interview buyers. Keep the conversation focused on the early stages of the buying journey. Ask why the buyer began looking for a new solution. Also: how did they justify the investment, who was involved in the buying process, which alternatives were considered, etc? You should allocate half the interview to these early stages and the other half to their assessment and decision.

Step 3: Identify and tag key attributes. Let your inner Sherlock Holmes guide you as you identify and tag key attributes of each buyer’s journey. For a quick analysis, use a spreadsheet. Put attributes in the rows. And put the opportunities in the columns, grouped by won or lost outcome. As you review each interview transcript, record details about each attribute in that column’s cells. Or use one of the dozens of off-the-shelf SaaS tools for qualitative data analysis like EnjoyHQ or Condens. Flexible, scalable tagging is a key advantage these tools have over spreadsheets.

Step 4: Calculate the win rate for each key attribute by dividing the number of times it was present in wins by the total number of times it occurred (both won and lost opportunities). We’ve found the quadrant below is quickly understood by the stakeholders who will need to understand and act on this analysis, but aren’t steeped in all the supporting details.

Step 5: Cluster analysis. Look up and down the rows in your spreadsheet to find groups of attributes that occur together. Then look back at your interview transcripts to learn why these attributes have clustered together. Complex buying decisions are rarely driven by one or two attributes alone. Finding and understanding these patterns will improve your ability to target these segments.

Step 6: Share your findings. The bigger the impact you seek to have, the more people you’ll need to influence. With the quadrant above, we can quickly show the overall patterns. We then explain in separate slides why each of the most prevalent attributes has a positive or negative influence on outcomes with interview excerpts.

Check our win/loss analysis template for an expanded explanation of these steps.

Grow Profitably because Growth at Any Cost is Out

Improve the efficiency and effectiveness of your marketing programs by shifting your focus (and budgets) to best-fit personas and ICPs.

Rather than intuition, I recommend using a data-driven approach to identify which buyers are best to target.

Since we’re more profitable when we win more deals, a win/loss analysis of buyer interviews is a powerful way to make these updates. Interview buyers in won and lost deals to identify the attributes that truly define your best fit buyer. In one quarter or less, product marketing can significantly impact the efficiency of demand generation and field marketing.

Author

-

Willem Maas, a professional with 28 years of expertise in Win/Loss Analysis, has significantly contributed to companies like HNC Software, U.S. Green Building Council, and Vigilent. His extensive experience reflects a deep understanding of strategic analysis. For questions or inquiries, please contact [email protected].

View all posts