Learn the definition of win-loss ratio and how to calculate it using a win-loss calculator formula. Explore ways to conduct analysis by gathering quantitative and qualitative data.

Time to read: 9 minutes

Key takeaways:

- Win-loss analysis is a process that organizations use to gather data and understand why they won or lost an opportunity.

- There are many approaches to calculating win-loss ratio and analyzing other outcomes. We outline formulas for analyzing win rate, competitive win rate, and more.

- Quantitative data, such as the discrete number of opportunities won or lost, can help inform analysis.

- Businesses can also use qualitative data to gather detailed insight into why an opportunity failed or succeeded.

- Win-loss analysis can benefit marketing, product, sales, and the company overall.

What is win-loss analysis?

Win-loss analysis is a process companies use to understand the factors that lead to completing or winning a sale, compared to the factors that lead to losing the sale. This helps companies evaluate the steps that recent evaluators took during the buying process. Moreover, it helps us understand why the evaluators did or did not buy. The win-loss analysis is an objective look at the opinions and decisions of prospects who chose to buy from a company compared to prospects who purchased from a competitor or did not buy at all.

Why is win-loss analysis important?

Win-loss analysis helps companies gather competitive intelligence. By conducting one-on-one interviews with recent evaluators (including buyers and non-buyers), companies can collect fresh data from their target audience of buyers. interviews should be completed soon after the sales process ends so the experience is fresh in the evaluator’s mind. This should also be conducted by a product manager to help control for bias from sales teams.

Let’s zoom out to understand the broader picture of conducting a win-loss analysis, which is a critical analysis for product managers and product marketers. It is a post-mortem evaluation of why your company won or lost a customer. Win-loss analysis allows product professionals to gather information directly from the customer or former prospect through one-on-one interviews. This interview may include questions about your product features and pricing, your company, and the customer’s sales experience.

Regularly completing detailed win-loss analyses can help companies understand:

- How their products are perceived in the market

- How competitive their pricing is

- How effective their sales and marketing programs are

- How their company’s reputation is perceived

- What their buyers’ decision-making processes are like

- What product features they are missing

- Who their biggest competitors are

If you’re new to product management, read our article outlining how to conduct a win-loss analysis. It can help your entire organization improve customer acquisition and retention strategies and grow the business.

Using Quantitative Data for Win-Loss Analysis

There are many ways to conduct a win-loss analysis. Incorporating quantitative (numbers-based and measurable) and qualitative (interpretation-based and descriptive) data into your analysis will help you find detailed insights from your evaluators.

When looking at quantitative data, several formulas will help you with the following win-loss analysis tasks:

- Compare the number of opportunities won against the number of opportunities lost

- Understand how lost and won opportunities compare to your total opportunities

- Identify sales or product segments that are overperforming or underperforming

Formula for Calculating Win-Loss Ratio

The win-loss ratio is calculated as the percentage of won opportunities over lost opportunities.

Win-Loss Ratio (%) = # of Opportunities Won / # of Opportunities Lost

For example, if your team had 3 won opportunities and 7 lost opportunities, the Win-Loss Ratio is 42.8% (3 / 7 = 42.8%).

Formula for Calculating Win Rate

Win rate is calculated as the percentage of total sales opportunities your team successfully turns into paying customers or clients.

Win Rate (%) = # of Opportunities Won / # of Total Opportunities

For example, if your team had 10 total opportunities and won 3 opportunities, the Win Rate is 30% (3 / 10 = 30%).

Tip: When calculating win rate, calculate it for all total opportunities and again while excluding open and in-progress opportunities that may still close in the future.

Formula for Calculating Competitive Win Rate

Calculating competitive win rate helps you understand your team’s success rate in opportunities when you are directly competing with another solution. This looks specifically at opportunities where your customer or client was shopping for a solution and comparing your product or service against a competitor.

When calculating the competitive win rate, you can group all your competitive deals to calculate an overall rate. Or you can separate each competitor to calculate a competitor win rate.

Competitive Win Rate (%) = # of Opportunities Where You Were Against a Competitor / # of Total Opportunities Where You Were Against a Competitor

For example, if your team had 3 total opportunities against competitors and won 2 opportunities, the Competitive Win Rate is 66.6% (2 / 3 = 66.6%).

Tip: You can also group your competitors into tiers to calculate your win rate by direct, indirect, and aspirational competitive deals. The formula for the tiered competitive win rate is the same as the overall competitive win rate, but again should only include wins and opportunities within your designated competitor tiers.

Formula for Calculating Win Rate by Sales Segment

Calculating win rate by sales segment helps you see how each of your sales teams is performing.

Sales Segment Win Rate (%) = # of Opportunities Won by Sales Segment / # of Total Opportunities by that Sales Segment

If you have one enterprise sales team and one mid-market sales team, you can calculate the win rate for both so you can see which team performs better or has opportunities to improve.

For example, if the enterprise sales team had 12 total opportunities and won 2 opportunities, the Enterprise Segment Win Rate is 16.6% (2 / 12 = 16.6%). On the other hand, if the mid-market sales team had 27 total opportunities and won 10 opportunities, the Mid-Market Segment Win Rate is 37% (10 / 27 = 37%). This may indicate that the Enterprise Segment, with a lower win rate, should improve its sales tactics.

Formula for Calculating Win Rate by Product

Calculating win rate by product helps you see how different products are performing. This is particularly helpful if your company sells more than one product and has specific sales teams or reps dedicated to selling that product.

This can help you understand which products are selling more effectively. This can also help you allocate more sales enablement resources to help your team sell underselling products. If you identify the loss reasons by product, you can use that feedback to improve the product and better serve your market’s needs.

Product Win Rate (%) = # of Opportunities Won by Product / # of Total Opportunities by that Product

For example, if the Juicer Product had 34 total opportunities and won 8 opportunities, the Juicer Product Win Rate is 23.5% (8 / 34 = 23.5%). On the other hand, if the Smoothie Product had 127 total opportunities and won 63 opportunities, the Smoothie Product Win Rate is 49.6% (63 / 127 = 49.6%). That indicates that the Smoothie Product is selling more effectively than the Juicer Product.

Formula for Calculating Loss Rate by Reason

Understanding how many deals were lost because of budgets, timeliness, or features allows you to make improvements to your sales or product to help address your market’s needs.

Loss Rate by Reason (%) = # of Losses by Reason / # of Total Losses

For example, if you lost 50 total deals, and 8 were lost due to pricing, the Loss Rate for Pricing is 16% (8 / 50 = 16%).

How Often Should You Calculate Win-Loss Ratio?

Formulas like win-loss ratio should be calculated on a cadence that mirrors your sales quota. We recommend calculating these metrics at least every month and every quarter. This allows you to monitor successes and progress over time and identify new opportunities for improvement. You can set up reports in your CRM to automatically generate these reports regularly.

Collecting Qualitative Data

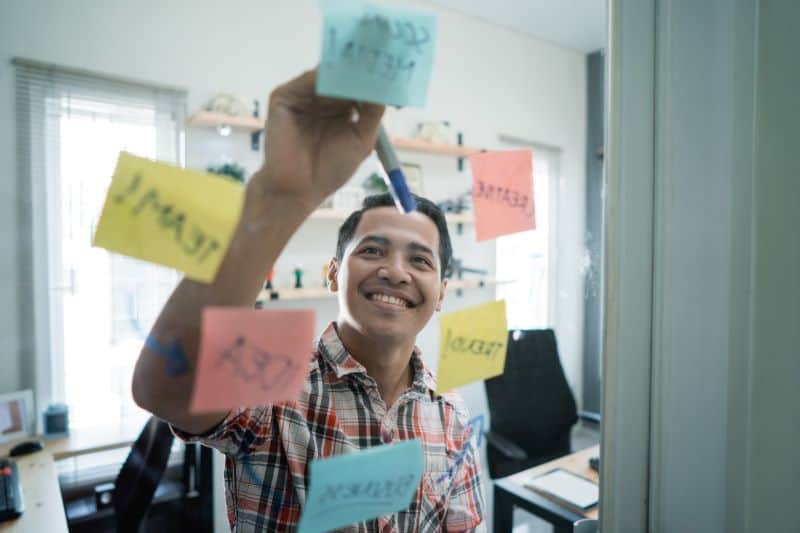

Qualitative data can help complement your quantitative analysis and uncover the “why” behind your wins and losses. Qualitative data can be collected in multiple ways, including through internal and external interviews.

Internal Interviews

Internal interviews are conducted with your sales team to get their perspective on why they won or lost specific deals. This can help product teams identify opportunities for better training, resources, and campaigns. Internal interviews can also give you insight into how you can improve your sales enablement efforts. For example, if you’re actively working to improve enablement materials for a specific vertical, you can survey your sales team during this initiative to understand if they feel better equipped with new collateral and training. Furthermore, you can identify which resources have been most helpful for them as they approach their deals.

External Interviews

External interviews are conducted with evaluators, such as customers and prospects. These interviews are external because the interviewees are outside of your organization. External interviews can help you understand your products and the sales process from a potential customer’s point of view. You want to gather honest feedback about why the evaluator chose the solutions they did.

Ideally, companies should leverage third-party firms to conduct interviews. This can gather more honest feedback. At the very least, the interviewer should not be from the sales team, as this may bias the interviewee’s responses.

There are many questions you could ask to find out why you won or lost a deal; be sure to ask follow-up questions to get the real “why” behind the decision. Here are some questions to get you started.

- Were there any specific product features or services from other vendors that impressed you?

- If all prices were equal, which vendor would you have chosen?

- What was the most significant contributor to your final decision?

- What was your overall experience like working with our team?

- What was your decision-making process like?

- What did you like/dislike most about our product/service?

- Do you have any advice for us as we work to make our sales experience and product better?

- Would you consider our services again in the future?

What is the right mix of data for win-loss analysis?

You can combine one-on-one interviews with surveys of your customers and prospects to collect more data about specific areas of interest. For example, if you find through your interviews that pricing was a key factor in many decisions, you can run a survey with more sales opportunities to gather their feedback on this specific topic.

This survey and interview data, combined with win-loss ratio data from your own sales tools, can give you a detailed view of the overall process and results for your company.

We recommend starting with 5 internal and external interviews. Once you have reached saturation in your qualitative interviews, or you start hearing the same answers over and over in different interviews, you can begin to draw conclusions from the interviews.

Benefits of Win-Loss Analysis for Your Company

Your win-loss analysis has benefits for multiple teams within your organization. There are benefits for your Sales, Marketing, and Product teams. For each team, you should talk through the data and analyze your findings. Discuss how each team can take action from the insights you uncover.

Benefits for Sales

Win-loss analyses help your sales teams immensely. This can be on a personal level, such as why a specific rep lost a deal. It can also be on an organizational level, uncovering the strongest and weakest areas of the team. Teams can foster learning opportunities for sales teams using win and loss data to improve the sales process and win future deals.

Benefits for Marketing

For marketing, win-loss analyses can highlight aspects of your brand that potential customers appreciate, as well as highlight your weaknesses. With this information, your marketing team can fine-tune messaging, adjust campaigns, and create stronger content to highlight your company’s strengths.

Benefits for Product

Your win-loss analysis can help drive product decisions and investments. It is important to know what works, what doesn’t, what your product is missing, and what makes your customers happy. This information can help your product team develop new features and direct product development.

Although a win-loss analysis is time-consuming, it also generates valuable data. This data will help improve your sales process and increase competitive win rates. It will also reveal new ways to develop your marketing and product strategies and grow your business overall.

Author

-

Ellie Mirman, a dynamic marketing leader with 20 years of experience, has left an indelible mark on high-growth companies like Solidworks, HubSpot, and Toast. An expert in building and scaling marketing efforts, she continues to influence the industry. For questions or inquiries, please contact [email protected].