[Originally posted at Tyner Blain blog]

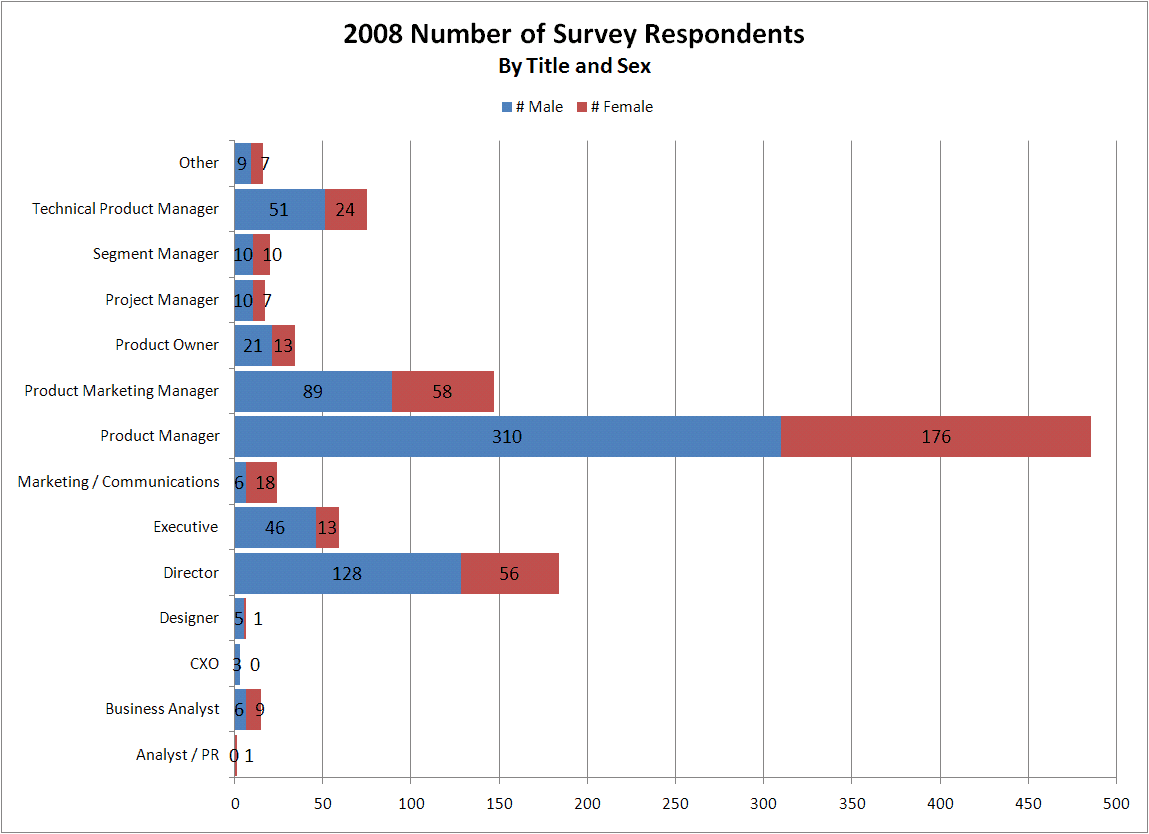

There were 1087 people who responded to the 2008 survey – 393 women and 694 men. Not all of them are product managers, however. Here’s the breakout of respondents by self-reported title and sex.

Presumably, all of the respondents are somewhere in the “product management zone” – either managing or working with product managers and product marketing managers. Otherwise, they probably wouldn’t respond to a survey by Pragmatic Institute.

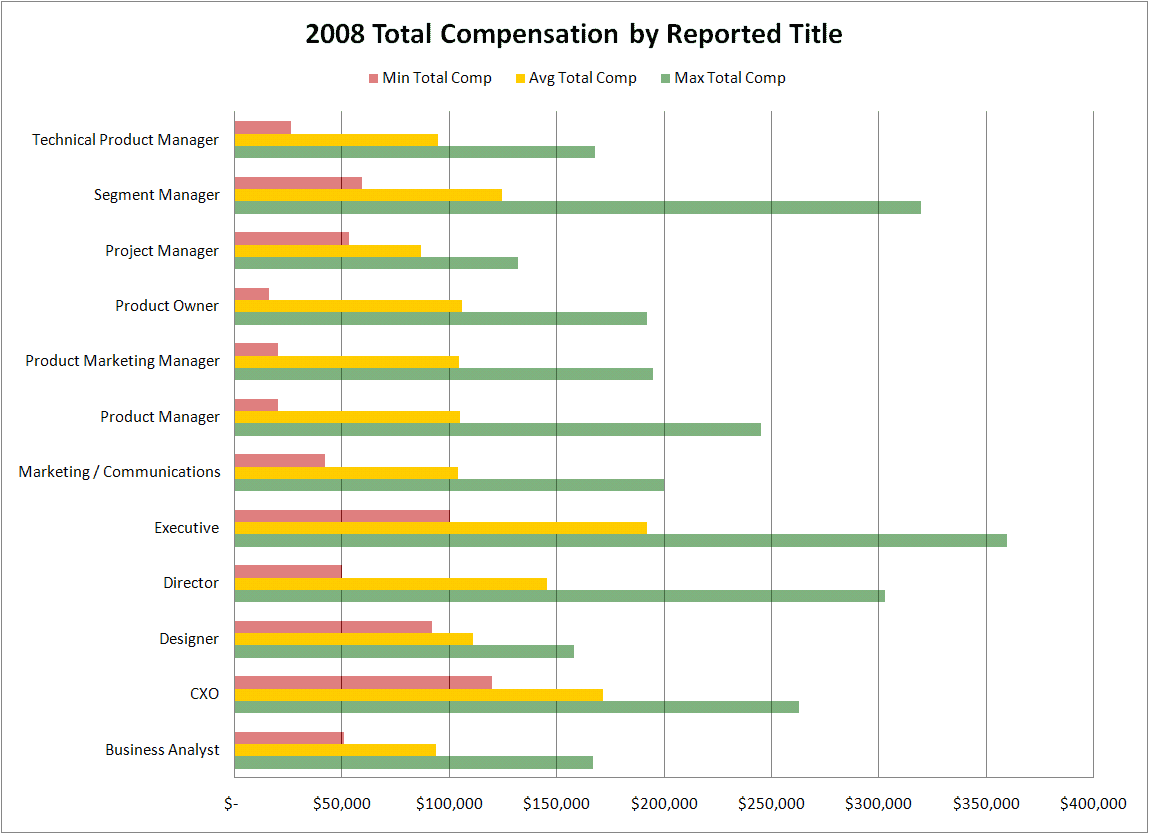

2008 Compensation Levels By Title

Reviewing compensation across this entire body of people really can prevent us from gaining insights about the job market for any particular role. Compensation was reported in this survey as a combination of salary and bonus. We’ll look at the data in terms of total compensation.

Note: In this, and all compensation analyses, we remove data that might identify a respondent to their peers. Imagine that a female designer mentions to her product manager friend that she has responded to the survey. If we were to show compensation data for designers, split by sex, that product manager would know what compensation our designer friend had reported. We don’t want that. Since there was only one Analyst / PR respondent, we filtered that out of the data.

A handful of people also reported $0 or $1000 salaries – we removed that data as well. These filters are the reason you may see different min/max/average values from different analyses of this data set.

All compensation data is in US dollars, as was specified in the original survey questions.

Here’s how minimum, maximum, and average total compensation break out by reported title for 2008.

No big surprises in that executives and directors make more than everyone else. The ranges in reported total compensation are larger than I would have suspected. This may reflect increased international participation in the survey versus previous years. Smaller ranges are probably to be found in any particular (regional) market. More analysis is needed to see if the data supports this hypothesis.

The product managers, with 486 responses in the survey, provide us with the most interesting population to study.

2008 Product Manager Surveyed Compensation

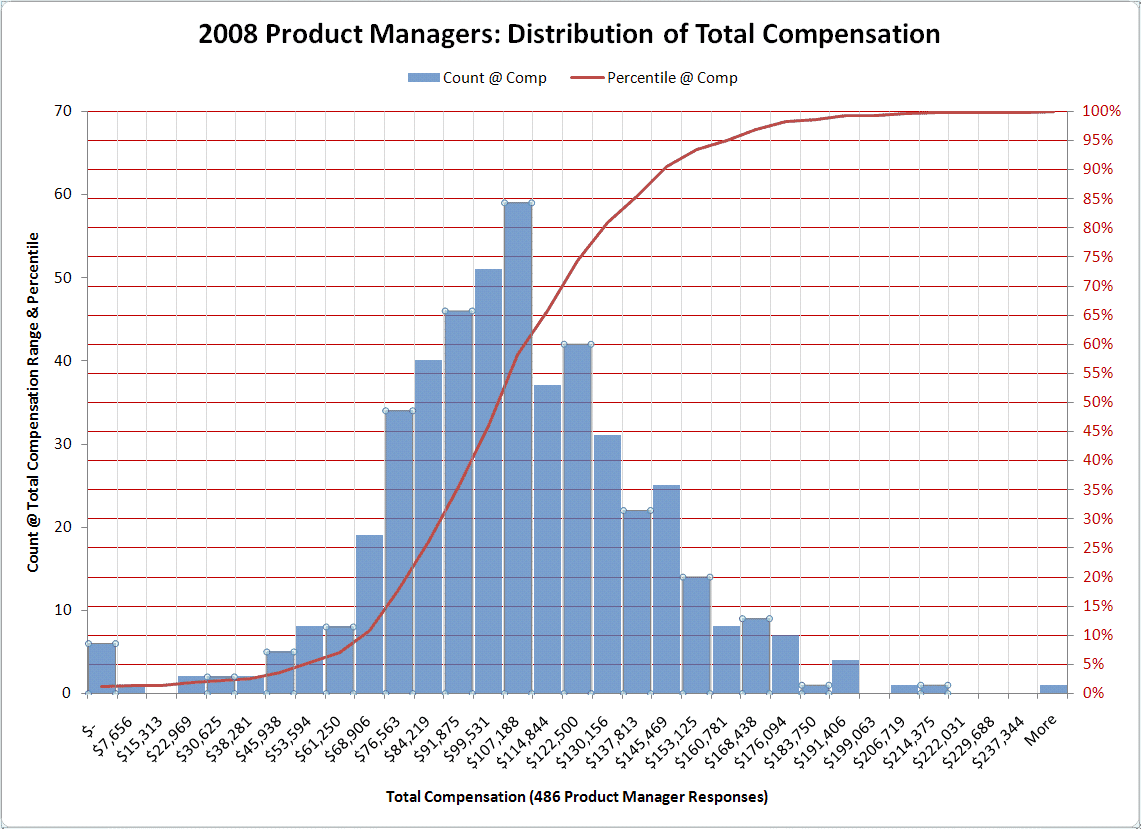

While there is still more work to do, if you’re a product manager, you can look at the following graph and see how your compensation compares with the respondents who self-identified as product managers in Pragmatic Institute’s 2008 survey.

The blue bars in the histogram above represent the number of responses in each range of total compensation (values in black on the left vertical axis indicate # of respondents). For example, 51 product managers reported total compensation in 2008 of between $91,875 and $99531. [Note: the non-rounded numbers were selected by Excel automatically to provide ‘usable’ insights into the data, and I didn’t feel like overriding the defaults].

Note that this diagram does reflect that 6 product managers (just over 1%) elected to not report total compensation.

The red line represents the cumulative percentage of product managers reporting at or below a dollar amount for total compensation. This is useful for determining your percentile rank among survey respondents. You do that by:

- Finding where your total compensation would be for 2008 along the horizontal axis

- Tracing straight up until you hit the red curve

- Tracing to the right from that red curve until you reach the right axis on the chart

- Estimating the percentage relative to the (red) numbers on the scale.

This estimated percentage tells you what percent of product managers (who responded to the survey) reported lower total compensation than you. As an example, a product manager that earned $125,000 in 2008 would have earned more than approximately 75% of the survey respondents. Depending on what you earn, this is either great ammo for a conversation with your boss or something you hope she hasn’t seen.

Scott Sehlhorst has been helping companies achieve Software ProductSuccess for more than a decade. Scott consults as a business architect, business analyst, and product manager. He has also worked as a technical consultant, developer, project manager, and program manager. Scott has managed teams from 5 to 50 persons and has delivered millions of dollars in value to his customers. Contact Scott at [email protected], or join in on the Tyner Blain blog at http://tynerblain.com/blog.

Author

-

The Pragmatic Editorial Team comprises a diverse team of writers, researchers, and subject matter experts. We are trained to share Pragmatic Institute’s insights and useful information to guide product, data, and design professionals on their career development journeys. Pragmatic Institute is the global leader in Product, Data, and Design training and certification programs for working professionals. Since 1993, we’ve issued over 250,000 product management and product marketing certifications to professionals at companies around the globe. For questions or inquiries, please contact [email protected].

View all posts